Bitcoin Whitepaper - Annotated

The following is an annotated version of the 2008 Bitcoin Whitepaper by the pseudonymous Satoshi Nakamoto where the original is displayed in dark text and annotations in lighter text.

This was a very useful exercise and it helped me appreciate both the history leading to Satoshi's discovery and also why Bitcoin and blockchains are such an important invention. The succinctness of the paper also stands out as quite beautiful.

Ultimately Bitcoin is a work of genius. The fact that a trusted, permissionless, distributed, immutable ledger exists and has processed enormous value for many years is truly amazing. It demarcates an important point for human history.

Without further ado, may I present...

Bitcoin: A Peer-to-Peer Electronic Cash System

Satoshi Nakamoto

satoshin@gmx.com

www.bitcoin.org

1. Introduction

2. Transactions

3. Timestamp Server

4. Proof-of-Work

5. Network

6. Incentive

7. Reclaiming Disk Space

8. Simplified Payment Verification

9. Combining and Splitting Value

10. Privacy

11. Calculations

12. Conclusion

References

The original Bitcoin whitepaper (2008) is displayed in dark text with annotations below in lighter text.

Bitcoin (₿) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Satoshi Nakamoto is the name used by the presumed pseudonymous person or persons who developed bitcoin.

bitcoin.org was registered on 18 Aug 2008.

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they'll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

1. Introduction

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non- reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers. In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions. The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes.

One of the most valuable properties of many blockchain applications is trustlessness: the ability of the application to continue operating in an expected way without needing to rely on a specific actor to behave in a specific way even when their interests might change.

Double-spending is a potential flaw in a digital cash scheme in which the same single digital token can be spent more than once.

Peer-to-peer computing or networking is a distributed application architecture that partitions tasks or workloads between peers.

Trusted timestamping is the process of securely keeping track of the creation and modification time of a document. Security here means that no one—not even the owner of the document—should be able to change it once it has been recorded.

In a distributed system, the nodes are clients, servers or peers. A peer may sometimes serve as client, sometimes server.

2. Transactions

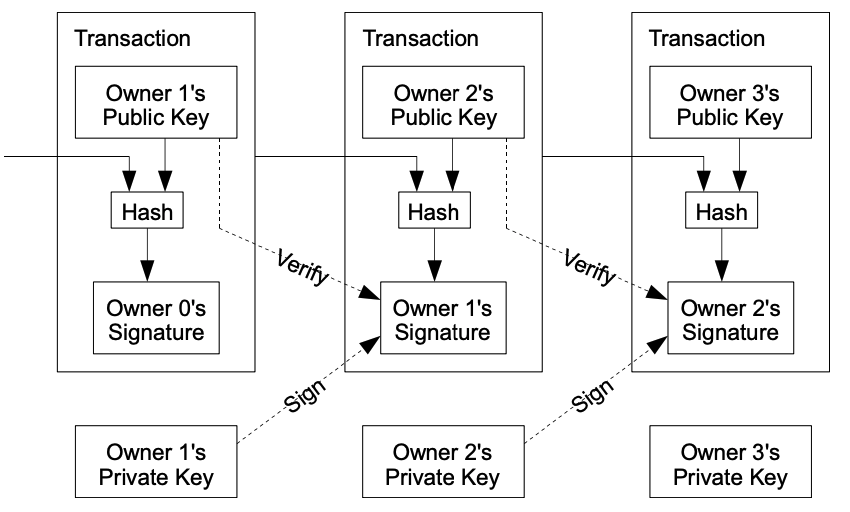

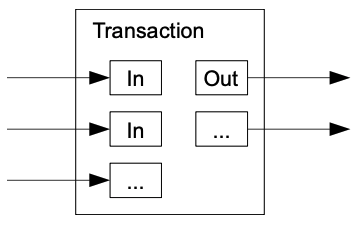

We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership.

The problem of course is the payee can't verify that one of the owners did not double-spend the coin. A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending. After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent. The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

We need a way for the payee to know that the previous owners did not sign any earlier transactions. For our purposes, the earliest transaction is the one that counts, so we don't care about later attempts to double-spend. The only way to confirm the absence of a transaction is to be aware of all transactions. In the mint based model, the mint was aware of all transactions and decided which arrived first. To accomplish this without a trusted party, transactions must be publicly announced [1], and we need a system for participants to agree on a single history of the order in which they were received. The payee needs proof that at the time of each transaction, the majority of nodes agreed it was the first received.

A digital signature (2) is a mathematical scheme for verifying the authenticity of digital messages or documents.

A cryptographic hash function is a mathematical algorithm that maps data of an arbitrary size to a bit array of a fixed size (the hash value). It is a one-way function, in that it is practically infeasible to reverse the computation.

A transaction is a transfer of Bitcoin value that is broadcast to the network and collected into blocks.

Public-key cryptography, or asymmetric cryptography, is a cryptographic system that uses pairs of keys. Each pair consists of a public key (which may be known to others) and a private key (which may not be known by anyone except the owner).

A mint is an industrial facility which manufactures coins that can be used as currency.

[1] W. Dai, "b-money", 1998

Wei Dai is a computer engineer known for contributions to cryptography and cryptocurrencies.

3. Timestamp Server

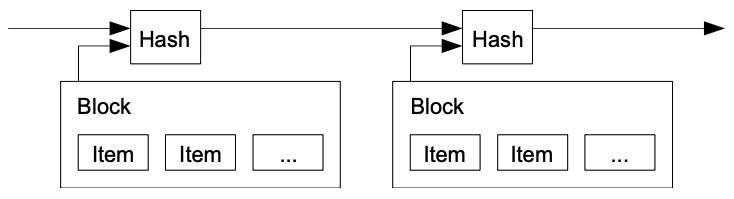

The solution we propose begins with a timestamp server. A timestamp server works by taking a hash of a block of items to be timestamped and widely publishing the hash, such as in a newspaper or Usenet post [2-5]. The timestamp proves that the data must have existed at the time, obviously, in order to get into the hash. Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.

To form a distributed timestamp server as a peer-to-peer network, bitcoin uses a proof-of-work system. This work is often called bitcoin mining.

Blocks contain the transactions on the bitcoin network. The on-chain transaction processing capacity of the network is limited by the average block creation time and the block size limit. These jointly constrain the network's throughput.

A blockchain is a list of cryptographically linked blocks typically managed by a peer-to-peer network for use as a publicly distributed ledger.

[2] H. Massias, X.S. Avila, and J.-J. Quisquater, "Design of a secure timestamping service with minimal trust requirements," In 20th Symposium on Information Theory in the Benelux, May 1999.

[3] S. Haber, W.S. Stornetta, "How to time-stamp a digital document," In Journal of Cryptology, vol 3, no 2, pages 99-111, 1991.

[4] D. Bayer, S. Haber, W.S. Stornetta, "Improving the efficiency and reliability of digital time-stamping," In Sequences II: Methods in Communication, Security and Computer Science, pages 329-334, 1993.

[5] S. Haber, W.S. Stornetta, "Secure names for bit-strings," In Proceedings of the 4th ACM Conference on Computer and Communications Security, pages 28-35, April 1997.

4. Proof-of-Work

To implement a distributed timestamp server on a peer-to-peer basis, we will need to use a proof-of-work system similar to Adam Back's Hashcash [6], rather than newspaper or Usenet posts. The proof-of-work involves scanning for a value that when hashed, such as with SHA-256, the hash begins with a number of zero bits. The average work required is exponential in the number of zero bits required and can be verified by executing a single hash.

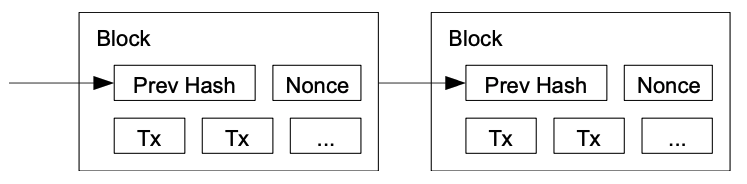

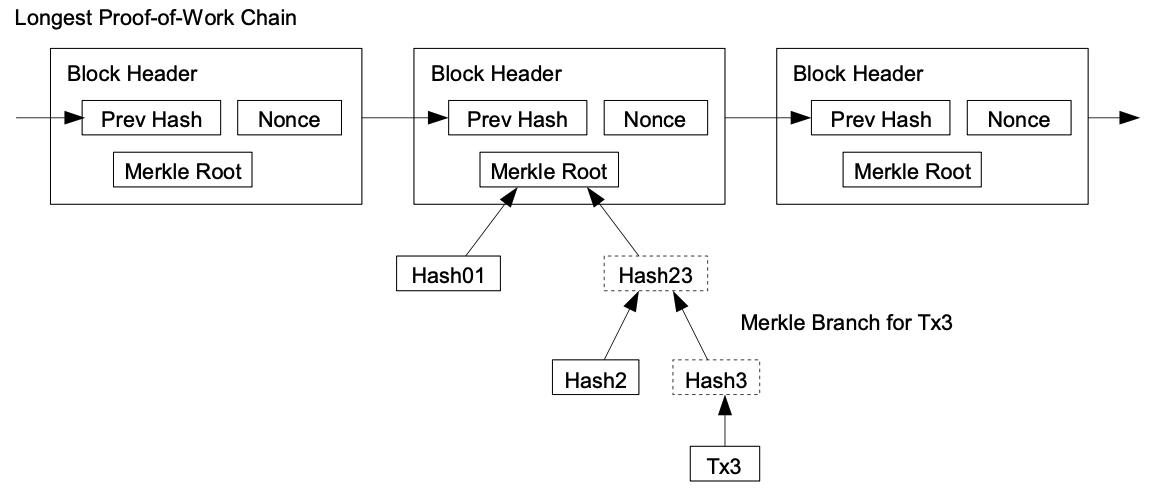

For our timestamp network, we implement the proof-of-work by incrementing a nonce in the block until a value is found that gives the block's hash the required zero bits. Once the CPU effort has been expended to make it satisfy the proof-of-work, the block cannot be changed without redoing the work. As later blocks are chained after it, the work to change the block would include redoing all the blocks after it.

The proof-of-work also solves the problem of determining representation in majority decision making. If the majority were based on one-IP-address-one-vote, it could be subverted by anyone able to allocate many IPs. Proof-of-work is essentially one-CPU-one-vote. The majority decision is represented by the longest chain, which has the greatest proof-of-work effort invested in it. If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes. We will show later that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.

To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they're generated too fast, the difficulty increases.

Proof-of-work is a cryptographic zero-knowledge proof in which one party (the prover) proves to others (the verifiers) that an amount of computational effort has been expended.

Bitcoin uses the hashcash double SHA-256 function for mining. This article by Ken Shirriff explains Bitcoin mining in details, right down to the hex data and network traffic.

[6] A. Back, "Hashcash - a denial of service counter-measure", 2002.

A nonce (number once) is an arbitrary number that can be used just once in a cryptographic communication.

PoW (one-CPU-one-vote) is a type of Sybil attack defence.

A Sybil attack is when an attacker creates a large number of pseudonymous identities and uses them to gain a large influence. Imposing economic costs may be used to make Sybil attacks more expensive.

Difficulty is a measure of how difficult it is to find a hash below a given target. A block is only accepted by the network if its hash meets the network's difficulty target.

5. Network

The steps to run the network are as follows:

- New transactions are broadcast to all nodes.

- Each node collects new transactions into a block.

- Each node works on finding a difficult proof-of-work for its block.

- When a node finds a proof-of-work, it broadcasts the block to all nodes.

- Nodes accept the block only if all transactions in it are valid and not already spent.

- Nodes express their acceptance of the block by working on creating the next block in the chain, using the hash of the accepted block as the previous hash.

Nodes always consider the longest chain to be the correct one and will keep working on extending it. If two nodes broadcast different versions of the next block simultaneously, some nodes may receive one or the other first. In that case, they work on the first one they received, but save the other branch in case it becomes longer. The tie will be broken when the next proof-of-work is found and one branch becomes longer; the nodes that were working on the other branch will then switch to the longer one.

New transaction broadcasts do not necessarily need to reach all nodes. As long as they reach many nodes, they will get into a block before long. Block broadcasts are also tolerant of dropped messages. If a node does not receive a block, it will request it when it receives the next block and realizes it missed one.

Bitcoin forks can be defined as changes in the protocol of the bitcoin network or in situations when two or more blocks have the same block height.

The fork is resolved when subsequent blocks are added and one of the chains becomes longer than the alternative.

Forks require consensus to be resolved or else a permanent split emerges.

A soft fork is a change that makes some block, that was previously legal, illegal.

A hard fork is a change that makes some block, that was previously illegal, legal.

With a soft fork the network will occasionally split but quickly converge, whereas with a hard fork the network will split into two separate chains, which will continue growing in parallel indefinitely.

6. Incentive

By convention, the first transaction in a block is a special transaction that starts a new coin owned by the creator of the block. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.

The incentive can also be funded with transaction fees. If the output value of a transaction is less than its input value, the difference is a transaction fee that is added to the incentive value of the block containing the transaction. Once a predetermined number of coins have entered circulation, the incentive can transition entirely to transaction fees and be completely inflation free.

The incentive may help encourage nodes to stay honest. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins. He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

Satoshi Nakamoto mined the Bitcoin genesis block on 3 Jan 2009 and annouced v0.1 of the project on 9 Jan 2009.

The genesis block reward was 50 bitcoin and embedded in the transaction was the text: "The Times Jan/03/2009 Chancellor on brink of second bailout for banks".

.jpeg)

A miner finding a new block collects all transaction fees in the block and a pre-determined block reward of newly created bitcoins.

Transaction fees are optional and miners can choose which transactions to process and prioritize those paying higher fees.

Bitcoin supply is limited and will approach a maximum of 21 million with issuance permanently halting c. 2140.

7. Reclaiming Disk Space

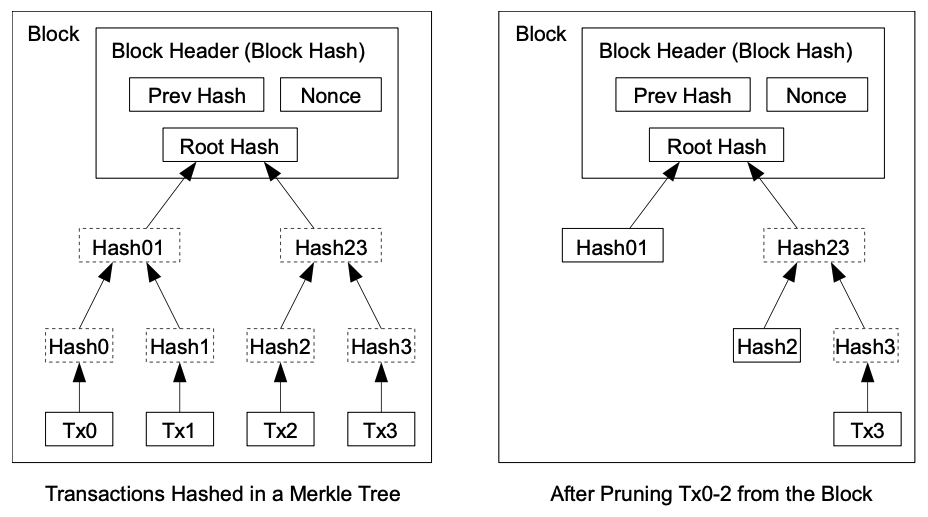

Once the latest transaction in a coin is buried under enough blocks, the spent transactions before it can be discarded to save disk space. To facilitate this without breaking the block's hash, transactions are hashed in a Merkle Tree [7][2][5], with only the root included in the block's hash. Old blocks can then be compacted by stubbing off branches of the tree. The interior hashes do not need to be stored.

A block header with no transactions would be about 80 bytes. If we suppose blocks are generated every 10 minutes, 80 bytes * 6 * 24 * 365 = 4.2MB per year. With computer systems typically selling with 2GB of RAM as of 2008, and Moore's Law predicting current growth of 1.2GB per year, storage should not be a problem even if the block headers must be kept in memory.

A Merkle tree is a tree in which every leaf node is labelled with the cryptographic hash of a data block, and every non-leaf node is labelled with the cryptographic hash of the labels of its child nodes.

Merkle tree allows efficient and secure verification of the contents of large data structures.

Ralph Merkle is one of the inventors of public-key cryptography and the inventor of cryptographic hashing.

[7] R.C. Merkle, "Protocols for public key cryptosystems," In Proc. 1980 Symposium on Security and Privacy, IEEE Computer Society, pages 122-133, April 1980.

[2] H. Massias, X.S. Avila, and J.-J. Quisquater, "Design of a secure timestamping service with minimal trust requirements," In 20th Symposium on Information Theory in the Benelux, May 1999.

[5] S. Haber, W.S. Stornetta, "Secure names for bit-strings," In Proceedings of the 4th ACM Conference on Computer and Communications Security, pages 28-35, April 1997.

8. Simplified Payment Verification

It is possible to verify payments without running a full network node. A user only needs to keep a copy of the block headers of the longest proof-of-work chain, which he can get by querying network nodes until he's convinced he has the longest chain, and obtain the Merkle branch linking the transaction to the block it's timestamped in. He can't check the transaction for himself, but by linking it to a place in the chain, he can see that a network node has accepted it, and blocks added after it further confirm the network has accepted it.

As such, the verification is reliable as long as honest nodes control the network, but is more vulnerable if the network is overpowered by an attacker. While network nodes can verify transactions for themselves, the simplified method can be fooled by an attacker's fabricated transactions for as long as the attacker can continue to overpower the network. One strategy to protect against this would be to accept alerts from network nodes when they detect an invalid block, prompting the user's software to download the full block and alerted transactions to confirm the inconsistency. Businesses that receive frequent payments will probably still want to run their own nodes for more independent security and quicker verification.

Full nodes download every block and transaction and check them against Bitcoin's consensus rules

In Simplified Payment Verification mode, clients connect to an arbitrary full node and download only the block headers.

They verify the chain headers connect together correctly and that the difficulty is high enough.

The level of difficulty required to obtain confidence the remote node is not feeding you fictional transactions depends on your threat model.

By changing how deeply buried the block must be, you can trade off confirmation time vs cost of an attack.

Running a full node is the only way you can use Bitcoin in a trustless way.

A full node verifies all rules of the network: no bitcoins are spent unless owned, no coins are spent twice, inflation happens according to the schedule, blocks meet the network difficulty, etc.

9. Combining and Splitting Value

Although it would be possible to handle coins individually, it would be unwieldy to make a separate transaction for every cent in a transfer. To allow value to be split and combined, transactions contain multiple inputs and outputs. Normally there will be either a single input from a larger previous transaction or multiple inputs combining smaller amounts, and at most two outputs: one for the payment, and one returning the change, if any, back to the sender.

It should be noted that fan-out, where a transaction depends on several transactions, and those transactions depend on many more, is not a problem here. There is never the need to extract a complete standalone copy of a transaction's history.

A transaction typically references previous transaction outputs as new transaction inputs and dedicates all input Bitcoin values to new outputs.

An Unspent Transaction Output (UTXO) defines an output of a transaction that has not been spent, i.e. can be used as an input in a new transaction.

A bitcoin wallet balance is actually the sum of the UTXOs controlled by the wallet's private keys.

10. Privacy

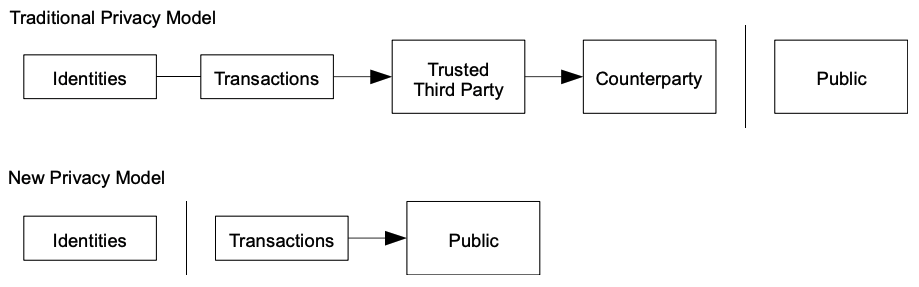

The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party. The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous. The public can see that someone is sending an amount to someone else, but without information linking the transaction to anyone. This is similar to the level of information released by stock exchanges, where the time and size of individual trades, the "tape", is made public, but without telling who the parties were.

As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner. Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner. The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner.

While Bitcoin can support strong privacy, many ways of using it are usually not very private.

With proper understanding, bitcoin can be used in a very private and anonymous way.

Transactions alone can't identify a person since addresses and transaction IDs are random numbers.

However, if any of the addresses in a transaction's past or future can be tied to an identity, it might be possible to deduce who owns the other addresses.

The encouraged practice of using a new address for every transaction is intended to make this attack more difficult.

11. Calculations

We consider the scenario of an attacker trying to generate an alternate chain faster than the honest chain. Even if this is accomplished, it does not throw the system open to arbitrary changes, such as creating value out of thin air or taking money that never belonged to the attacker. Nodes are not going to accept an invalid transaction as payment, and honest nodes will never accept a block containing them. An attacker can only try to change one of his own transactions to take back money he recently spent.

The race between the honest chain and an attacker chain can be characterized as a Binomial Random Walk. The success event is the honest chain being extended by one block, increasing its lead by +1, and the failure event is the attacker's chain being extended by one block, reducing the gap by -1.

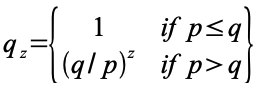

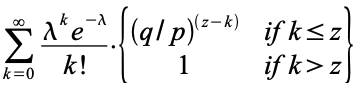

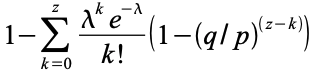

The probability of an attacker catching up from a given deficit is analogous to a Gambler's Ruin problem. Suppose a gambler with unlimited credit starts at a deficit and plays potentially an infinite number of trials to try to reach breakeven. We can calculate the probability he ever reaches breakeven, or that an attacker ever catches up with the honest chain, as follows [8]:

q = probability the attacker finds the next block

qz = probability the attacker will ever catch up from z blocks behind

Given our assumption that p > q, the probability drops exponentially as the number of blocks the attacker has to catch up with increases. With the odds against him, if he doesn't make a lucky lunge forward early on, his chances become vanishingly small as he falls further behind.

We now consider how long the recipient of a new transaction needs to wait before being sufficiently certain the sender can't change the transaction. We assume the sender is an attacker who wants to make the recipient believe he paid him for a while, then switch it to pay back to himself after some time has passed. The receiver will be alerted when that happens, but the sender hopes it will be too late.

The receiver generates a new key pair and gives the public key to the sender shortly before signing. This prevents the sender from preparing a chain of blocks ahead of time by working on it continuously until he is lucky enough to get far enough ahead, then executing the transaction at that moment. Once the transaction is sent, the dishonest sender starts working in secret on a parallel chain containing an alternate version of his transaction.

The recipient waits until the transaction has been added to a block and z blocks have been linked after it. He doesn't know the exact amount of progress the attacker has made, but assuming the honest blocks took the average expected time per block, the attacker's potential progress will be a Poisson distribution with expected value:

To get the probability the attacker could still catch up now, we multiply the Poisson density for each amount of progress he could have made by the probability he could catch up from that point:

Rearranging to avoid summing the infinite tail of the distribution...

Converting to C code...

#include <math.h>

double AttackerSuccessProbability(double q, int z)

{

double p = 1.0 - q;

double lambda = z * (q / p);

double sum = 1.0;

int i, k;

for (k = 0; k <= z; k++)

{

double poisson = exp(-lambda);

for (i = 1; i <= k; i++)

poisson *= lambda / i;

sum -= poisson * (1 - pow(q / p, z - k));

}

return sum;

}

Running some results, we can see the probability drop off exponentially with z.

q=0.1

z=0 P=1.0000000

z=1 P=0.2045873

z=2 P=0.0509779

z=3 P=0.0131722

z=4 P=0.0034552

z=5 P=0.0009137

z=6 P=0.0002428

z=7 P=0.0000647

z=8 P=0.0000173

z=9 P=0.0000046

z=10 P=0.0000012

q=0.3

z=0 P=1.0000000

z=5 P=0.1773523

z=10 P=0.0416605

z=15 P=0.0101008

z=20 P=0.0024804

z=25 P=0.0006132

z=30 P=0.0001522

z=35 P=0.0000379

z=40 P=0.0000095

z=45 P=0.0000024

z=50 P=0.0000006

Solving for P less than 0.1%...

P < 0.001

q=0.10 z=5

q=0.15 z=8

q=0.20 z=11

q=0.25 z=15

q=0.30 z=24

q=0.35 z=41

q=0.40 z=89

q=0.45 z=340

In mathematics a random walk is a random process that describes a path that consists of a succession of random steps on some mathematical space such as the integers.

The term gambler's ruin is a statistical concept, most commonly expressed as the fact that a gambler playing a game with negative expected value will eventually go broke, regardless of their betting system.

The Poisson distribution is a discrete probability distribution that expresses the probability of a given number of events in a fixed interval of time or space if these events occur with a constant mean rate and independently of the time since the last event.

A mining pool is the pooling of resources by miners, who share their processing power over a network, to split the reward equally, according to the amount of work they contributed to the probability of finding a block.

Any mining pool that achieves 51% hashing power can effectively overturn network transactions, resulting in double spending.

A model of the attack can be simulated via Monte Carlo methods.

Only 6 blocks or 1 hour is enough to make reversal computationally impractical.

12. Conclusion

We have proposed a system for electronic transactions without relying on trust. We started with the usual framework of coins made from digital signatures, which provides strong control of ownership, but is incomplete without a way to prevent double-spending. To solve this, we proposed a peer-to-peer network using proof-of-work to record a public history of transactions that quickly becomes computationally impractical for an attacker to change if honest nodes control a majority of CPU power. The network is robust in its unstructured simplicity. Nodes work all at once with little coordination. They do not need to be identified, since messages are not routed to any particular place and only need to be delivered on a best effort basis. Nodes can leave and rejoin the network at will, accepting the proof-of-work chain as proof of what happened while they were gone. They vote with their CPU power, expressing their acceptance of valid blocks by working on extending them and rejecting invalid blocks by refusing to work on them. Any needed rules and incentives can be enforced with this consensus mechanism.

The word consensus comes from Latin meaning "agreement, accord".

A fundamental problem in distributed computing is to coordinate processes to reach consensus on some data value that is needed during computation.

Proof-of-work is an example of a permissionless consensus protocol that allows anyone in the network to join dynamically and participate without prior permission.

A number of permissionless consensus protocols exist including proof-of-stake which selects validators in proportion to their quantity of holdings in the associated cryptocurrency and does not incentivise extreme amounts of energy consumption.

References

[1] W. Dai, "http://www.weidai.com/bmoney.txt", 1998

[2] H. Massias, X.S. Avila, and J.-J. Quisquater, "Design of a secure timestamping service with minimal trust requirements," In 20th Symposium on Information Theory in the Benelux, May 1999.

[3] S. Haber, W.S. Stornetta, "How to time-stamp a digital document," In Journal of Cryptology, vol 3, no 2, pages 99-111, 1991.

[4] D. Bayer, S. Haber, W.S. Stornetta, "Improving the efficiency and reliability of digital time-stamping," In Sequences II: Methods in Communication, Security and Computer Science, pages 329-334, 1993.

[5] S. Haber, W.S. Stornetta, "Secure names for bit-strings," In Proceedings of the 4th ACM Conference on Computer and Communications Security, pages 28-35, April 1997.

[6] A. Back, "Hashcash - a denial of service counter-measure," http://www.hashcash.org/papers/hashcash.pdf, 2002.

[7] R.C. Merkle, "Protocols for public key cryptosystems," In Proc. 1980 Symposium on Security and Privacy, IEEE Computer Society, pages 122-133, April 1980.

[8] W. Feller, "An introduction to probability theory and its applications," 1957.