Ethereum Whitepaper - Annotated

The following is an annotated version of the 2013 Ethereum Whitepaper by Vitalik Buterin where the original is displayed in dark text and annotations in lighter text.

I previously annotated the Bitcoin Whitepaper with a primarily purpose of understanding each section thoroughly by reading and summarising various background references. This was a very useful exercise and it helped me appreciate both the history leading to Satoshi's discovery and also why Bitcoin and blockchains are such an important invention.

Annotating the Ethereum Whitepaper was a more involved task as the scope is much larger and on-going research much deeper. Ethereum learns from and improves upon certain Bitcoin limitations. It includes a turing-complete programmatic smart contract layer and describes distributed trustless applications (that are today implemented and working) across finance, identity, reputation, prediction markets, file storage and even decentralized autonomous organizations. It also, importantly, is working towards a more environmentally friendly consensus mechanism than Bitcoin.

I found sections describing cryptoeconomic scenarios (where systems combine economic incentives with cryptography, particularly in adversarial environments) the most fascinating as currently implemented solutions draw from many different disciplines. Ultimately Ethereum is super exciting in that it offers a platform for automating certain archaic systems and removing the inherent weaknesses of the trust based model not only for payments and value transfer, but also for many more advanced applications and marketplaces.

Without further ado, may I present...

Ethereum: A Next-Generation Smart Contract and Decentralized Application Platform

1. Introduction to Bitcoin and Existing Concepts

2. Ethereum

3. Applications

4. Miscellanea And Concerns

5. Putting It All Together: Decentralized Applications

6. Conclusion

7. Notes and Further Reading

The original Ethereum whitepaper (2013) is displayed in dark text with annotations below in lighter text.

Ethereum (Ξ) is a decentralized, open-source blockchain with smart contract functionality.

Vitalik Buterin is a Russian-Canadian programmer and writer who is best known as one of the co-founders of Ethereum (vitalik.ca)

ethereum.org was registered on 27 Nov 2013.

A Next-Generation Smart Contract and Decentralized Application Platform

Satoshi Nakamoto's development of Bitcoin in 2009 has often been hailed as a radical development in money and currency, being the first example of a digital asset which simultaneously has no backing or "intrinsic value" and no centralized issuer or controller. However, another, arguably more important, part of the Bitcoin experiment is the underlying blockchain technology as a tool of distributed consensus, and attention is rapidly starting to shift to this other aspect of Bitcoin.

Commonly cited alternative applications of blockchain technology include using on-blockchain digital assets to represent custom currencies and financial instruments ("colored coins"), the ownership of an underlying physical device ("smart property"), non-fungible assets such as domain names ("Namecoin"), as well as more complex applications involving having digital assets being directly controlled by a piece of code implementing arbitrary rules ("smart contracts") or even blockchain-based "decentralized autonomous organizations" (DAOs). What Ethereum intends to provide is a blockchain with a built-in fully fledged Turing-complete programming language that can be used to create "contracts" that can be used to encode arbitrary state transition functions, allowing users to create any of the systems described above, as well as many others that we have not yet imagined, simply by writing up the logic in a few lines of code.

Satoshi Nakamoto is the name used by the presumed pseudonymous person or persons who developed bitcoin.

Bitcoin (₿) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

A blockchain is a list of cryptographically linked blocks typically managed by a peer-to-peer network for use as a publicly distributed ledger.

In 2013, Buterin briefly worked with eToro CEO Yoni Assia on the Colored Coins project.

Smart property is property whose ownership is controlled via a blockchain.

Namecoin is a key/value pair registration and transfer system based on the Bitcoin technology

A smart contract is a program that runs on a blockchain with the objectives of reduction in trusted intermediators, arbitrations, enforcement costs and fraud losses.

A decentralized autonomous organization (DAO) is an organization represented by rules encoded as a computer program that is transparent, controlled by the organization members and not influenced by a central government.

A programming language that is Turing complete is theoretically capable of expressing all tasks accomplishable by computers

1. Introduction to Bitcoin and Existing Concepts

1.1 History

The concept of decentralized digital currency, as well as alternative applications like property registries, has been around for decades. The anonymous e-cash protocols of the 1980s and the 1990s, mostly reliant on a cryptographic primitive known as Chaumian blinding, provided a currency with a high degree of privacy, but the protocols largely failed to gain traction because of their reliance on a centralized intermediary. In 1998, Wei Dai's b-money became the first proposal to introduce the idea of creating money through solving computational puzzles as well as decentralized consensus, but the proposal was scant on details as to how decentralized consensus could actually be implemented. In 2005, Hal Finney introduced a concept of "reusable proofs of work", a system which uses ideas from b-money together with Adam Back's computationally difficult Hashcash puzzles to create a concept for a cryptocurrency, but once again fell short of the ideal by relying on trusted computing as a backend.

Because currency is a first-to-file application, where the order of transactions is often of critical importance, decentralized currencies require a solution to decentralized consensus. The main roadblock that all pre-Bitcoin currency protocols faced is the fact that, while there had been plenty of research on creating secure Byzantine-fault-tolerant multiparty consensus systems for many years, all of the protocols described were solving only half of the problem. The protocols assumed that all participants in the system were known, and produced security margins of the form "if N parties participate, then the system can tolerate up to N/4 malicious actors". The problem is, however, that in an anonymous setting such security margins are vulnerable to sybil attacks, where a single attacker creates thousands of simulated nodes on a server or botnet and uses these nodes to unilaterally secure a majority share.

The innovation provided by Satoshi is the idea of combining a very simple decentralized consensus protocol, based on nodes combining transactions into a "block" every ten minutes creating an ever-growing blockchain, with proof of work as a mechanism through which nodes gain the right to participate in the system. While nodes with a large amount of computational power do have proportionately greater influence, coming up with more computational power than the entire network combined is much harder than simulating a million nodes. Despite the Bitcoin blockchain model's crudeness and simplicity, it has proven to be good enough, and would over the next five years become the bedrock of over two hundred currencies and protocols around the world.

A digital currency is any money-like asset managed, stored or exchanged on digital computer systems.

Ecash was conceived by David Chaum as an anonymous (but centralised) cryptographic electronic money system in 1983.

A Chaumian blinding is a form of digital signature in which the content of a message is disguised (blinded) before it is signed.

Wei Dai proposed B-money in 1998 as an "anonymous, distributed electronic cash system".

Hal Finney was an early bitcoin contributor.

Proof-of-work is a cryptographic zero-knowledge proof in which one party (the prover) proves to others (the verifiers) that an amount of computational effort has been expended. It is an example of a permissionless consensus protocol that allows anyone in the network to join dynamically and participate without prior permission.

Hashcash is a proof-of-work system proposed in 1997 by Adam Back.

A cryptocurrency is a sub-type of digital currency that relies on cryptography to chain together digital signatures of asset transfers.

A fundamental problem in distributed computing is to coordinate processes to reach consensus on some data value that is needed during computation.

A Byzantine fault is any fault presenting different symptoms to different observers. Byzantine fault tolerance is the dependability of a computer system to such conditions and can be achieved if the non-faulty participants have a consensus.

Nodes can be anonymous and there are no access controls in an open, permissionless blockchain.

A Sybil attack is when an attacker creates a large number of pseudonymous identities and uses them to gain a large influence. Imposing economic costs may be used to make Sybil attacks more expensive.

Proof-of-work is a cryptographic zero-knowledge proof in which one party (the prover) proves to others (the verifiers) that an amount of computational effort has been expended.

1.2 Bitcoin As A State Transition System

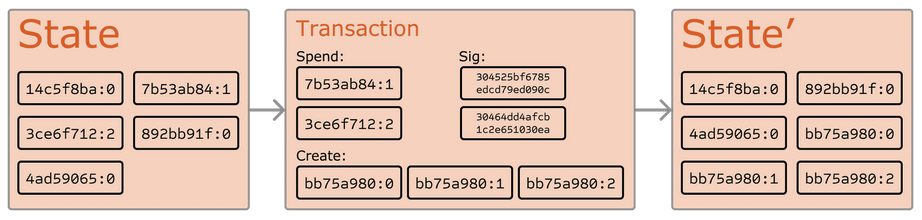

From a technical standpoint, the Bitcoin ledger can be thought of as a state transition system, where there is a "state" consisting of the ownership status of all existing bitcoins and a "state transition function" that takes a state and a transaction and outputs a new state which is the result. In a standard banking system, for example, the state is a balance sheet, a transaction is a request to move $X from A to B, and the state transition function reduces the value in A's account by $X and increases the value in B's account by $X. If A's account has less than $X in the first place, the state transition function returns an error. Hence, one can formally define:

APPLY(S,TX) > S' or ERROR

In the banking system defined above:

APPLY({ Alice: $50, Bob: $50 },"send $20 from Alice to Bob") = { Alice: $30, Bob: $70 }

But:

APPLY({ Alice: $50, Bob: $50 },"send $70 from Alice to Bob") = ERROR

The "state" in Bitcoin is the collection of all coins (technically, unspent transaction outputs" or UTXO) that have been minted and not yet spent, with each UTXO having a denomination and an owner (defined by a 20-byte address which is essentially a cryptographic public key[1]). A transaction contains one or more inputs, with each input containing a reference to an existing UTXO and a cryptographic signature produced by the private key associated with the owner's address, and one or more outputs, with each output containing a new UTXO to be added to the state.

The state transition function APPLY(S,TX) > S' can be defined roughly as follows:

1. For each input in TX:

i. If the referenced UTXO is not in S, return an error.

ii. If the provided signature does not match the owner of the UTXO, return an error.

2. If the sum of the denominations of all input UTXO is less than the sum of the denominations of

all output UTXO, return an error.

3. Return S with all input UTXO removed and all output UTXO added.

The first half of the first step prevents transaction senders from spending coins that do not exist, the second half of the first step prevents transaction senders from spending other people's coins, and the second step enforces conservation of value. In order to use this for payment, the protocol is as follows. Suppose Alice wants to send 11.7 BTC to Bob. First, Alice will look for a set of available UTXO that she owns that totals up to at least 11.7 BTC. Realistically, Alice will not be able to get exactly 11.7 BTC; say that the smallest she can get is 6+4+2=12. She then creates a transaction with those three inputs and two outputs. The first output will be 11.7 BTC with Bob's address as its owner, and the second output will be the remaining 0.3 BTC "change", with the owner being Alice herself.

A state transition system is a concept used in the study of computation to describe the potential behavior of discrete systems consisting of states and transitions between states.

An Unspent Transaction Output (UTXO) defines an output of a transaction that has not been spent, i.e. can be used as an input in a new transaction.

1.3 Mining

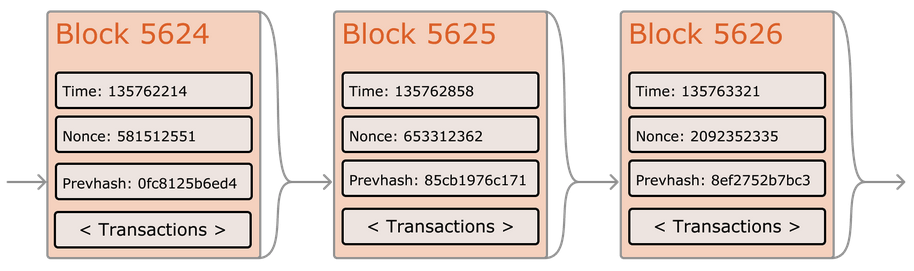

If we had access to a trustworthy centralized service, this system would be trivial to implement; it could simply be coded exactly as described. However, with Bitcoin we are trying to build a decentralized currency system, so we will need to combine the state transition system with a consensus system in order to ensure that everyone agrees on the order of transactions. Bitcoin's decentralized consensus process requires nodes in the network to continuously attempt to produce packages of transactions called "blocks". The network is intended to produce roughly one block every ten minutes, with each block containing a timestamp, a nonce, a reference to (ie. hash of) the previous block and a list of all of the transactions that have taken place since the previous block. Over time, this creates a persistent, ever-growing, "blockchain" that constantly updates to represent the latest state of the Bitcoin ledger.

The algorithm for checking if a block is valid, expressed in this paradigm, is as follows:

1. Check if the previous block referenced by the block exists and is valid

2. Check that the timestamp of the block is greater than that of the previous block[2] and less than 2 hours into the future.

3. Check that the proof of work on the block is valid.

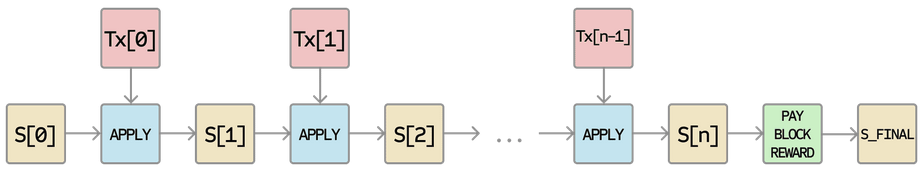

4. Let S[0] be the state at the end of the previous block.

5. Suppose TX is the block's transaction list with n transactions. For all i in 0...n-1, setS[i+1] =

APPLY(S[i],TX[i]) If any application returns an error, exit and return false.

6. Return true, and register S[n] as the state at the end of this block

Essentially, each transaction in the block must provide a state transition that is valid. Note that the state is not encoded in the block in any way; it is purely an abstraction to be remembered by the validating node and can only be (securely) computed for any block by starting from the genesis state and sequentially applying every transaction in every block. Additionally, note that the order in which the miner includes transactions into the block matters; if there are two transactions A and B in a block such that B spends a UTXO created by A, then the block will be valid if A comes before B but not otherwise.

The interesting part of the block validation algorithm is the concept of "proof of work": the condition is that the SHA256 hash of every block, treated as a 256-bit number, must be less than a dynamically adjusted target, which as of the time of this writing is approximately 2190. The purpose of this is to make block creation computationally "hard", thereby preventing sybil attackers from remaking the entire blockchain in their favor. Because SHA256 is designed to be a completely unpredictable pseudorandom function, the only way to create a valid block is simply trial and error, repeatedly incrementing the nonce and seeing if the new hash matches. At the current target of 2192, this means an average of 264 tries; in general, the target is recalibrated by the network every 2016 blocks so that on average a new block is produced by some node in the network every ten minutes. In order to compensate miners for this computational work, the miner of every block is entitled to include a transaction giving themselves 25 BTC out of nowhere. Additionally, if any transaction has a higher total denomination in its inputs than in its outputs, the difference also goes to the miner as a "transaction fee". Incidentally, this is also the only mechanism by which BTC are issued; the genesis state contained no coins at all.

In order to better understand the purpose of mining, let us examine what happens in the event of a malicious attacker. Since Bitcoin's underlying cryptography is known to be secure, the attacker will target the one part of the Bitcoin system that is not protected by cryptography directly: the order of transactions. The attacker's strategy is simple:

1. Send 100 BTC to a merchant in exchange for some product (preferably a rapid-delivery digital good)

2. Wait for the delivery of the product

3. Produce another transaction sending the same 100 BTC to himself

4. Try to convince the network that his transaction to himself was the one that came first.

Once step (1) has taken place, after a few minutes some miner will include the transaction in a block, say block number 270000. After about one hour, five more blocks will have been added to the chain after that block, with each of those blocks indirectly pointing to the transaction and thus "confirming" it. At this point, the merchant will accept the payment as finalized and deliver the product; since we are assuming this is a digital good, delivery is instant. Now, the attacker creates another transaction sending the 100 BTC to himself. If the attacker simply releases it into the wild, the transaction will not be processed; miners will attempt to run APPLY(S,TX) and notice that TX consumes a UTXO which is no longer in the state. So instead, the attacker creates a "fork" of the blockchain, starting by mining another version of block 270000 pointing to the same block 269999 as a parent but with the new transaction in place of the old one. Because the block data is different, this requires redoing the proof of work. Furthermore, the attacker's new version of block 270000 has a different hash, so the original blocks 270001 to 270005 do not "point" to it; thus, the original chain and the attacker's new chain are completely separate. The rule is that in a fork the longest blockchain (ie. the one backed by the largest quantity of proof of work) is taken to be the truth, and so legitimate miners will work on the 270005 chain while the attacker alone is working on the 270000 chain. In order for the attacker to make his blockchain the longest, he would need to have more computational power than the rest of the network combined in order to catch up (hence, "51% attack").

In regards to blockchain, reaching consensus means that at least 51% of the nodes on the network agree on the next global state of the network.

Blocks are batches of transactions with a hash of the previous block in the chain. This links blocks together (in a chain) because hashes are cryptographically derived from the block data.

SHA-2 (Secure Hash Algorithm 2) is a set of cryptographic hash functions designed by the NSA in 2001 and includes SHA-256.

Each transaction requires a fee since each Ethereum transaction uses computational resources to execute.

The way transaction fees on the Ethereum network were calculated changed with the London Upgrade of August 2021 (see EIP-1559).

Blockchain forks can be defined as changes in the protocol of the network or in situations when two or more blocks have the same block height.

When upgrades are needed in centrally-controlled software a company will publish a new version for the end-user. Blockchains work differently. Ethereum clients must update their software to implement the new fork rules.

Proof-of-work is the mechanism that allows the decentralized Ethereum network to come to consensus, or agree on things like account balances and the order of transactions.

Ethereum is moving to a proof-of-stake consensus mechanism in 2022. PoS has validators who stake ETH to participate in the system, rather than miners. This makes it much more energy efficient.

Any attacker that achieves 51% hashing power can effectively overturn network transactions, resulting in double spending.

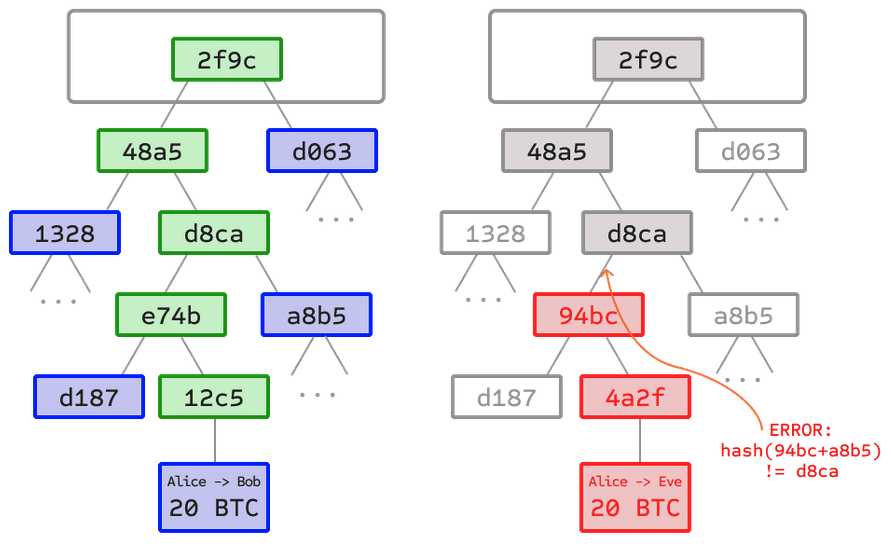

1.4 Merkle Trees

Left tree: it suffices to present only a small number of nodes in a Merkle tree to give a proof of the validity of a branch.

Right tree: any attempt to change any part of the Merkle tree will eventually lead to an inconsistency somewhere up the chain.

An important scalability feature of Bitcoin is that the block is stored in a multi-level data structure. The "hash" of a block is actually only the hash of the block header, a roughly 200-byte piece of data that contains the timestamp, nonce, previous block hash and the root hash of a data structure called the Merkle tree storing all transactions in the block.

A Merkle tree is a type of binary tree, composed of a set of nodes with a large number of leaf nodes at the bottom of the tree containing the underlying data, a set of intermediate nodes where each node is the hash of its two children, and finally a single root node, also formed from the hash of its two children, representing the "top" of the tree. The purpose of the Merkle tree is to allow the data in a block to be delivered piecemeal: a node can download only the header of a block from one source, the small part of the tree relevant to them from another source, and still be assured that all of the data is correct. The reason why this works is that hashes propagate upward: if a malicious user attempts to swap in a fake transaction into the bottom of a Merkle tree, this change will cause a change in the node above, and then a change in the node above that, finally changing the root of the tree and therefore the hash of the block, causing the protocol to register it as a completely different block (almost certainly with an invalid proof of work).

The Merkle tree protocol is arguably essential to long-term sustainability. A "full node" in the Bitcoin network, one that stores and processes the entirety of every block, takes up about 15 GB of disk space in the Bitcoin network as of April 2014, and is growing by over a gigabyte per month. Currently, this is viable for some desktop computers and not phones, and later on in the future only businesses and hobbyists will be able to participate. A protocol known as "simplified payment verification" (SPV) allows for another class of nodes to exist, called "light nodes", which download the block headers, verify the proof of work on the block headers, and then download only the "branches" associated with transactions that are relevant to them. This allows light nodes to determine with a strong guarantee of security what the status of any Bitcoin transaction, and their current balance, is while downloading only a very small portion of the entire blockchain.

A Merkle tree is a tree in which every leaf node is labelled with the cryptographic hash of a data block, and every non-leaf node is labelled with the cryptographic hash of the labels of its child nodes.

Merkle tree allows efficient and secure verification of the contents of large data structures.

Ralph Merkle is one of the inventors of public-key cryptography and the inventor of cryptographic hashing.

Full nodes download every block and transaction and check them against Ethereums's consensus rules. A light node stores the header chain and requests everything else. Further, an archive node stores everything kept in the full node and builds an archive of historical states.

In Simplified Payment Verification mode, clients connect to an arbitrary full node and download only the block headers. They verify the chain headers connect together correctly and that the difficulty is high enough.

1.5 Alternative Blockchain Applications

The idea of taking the underlying blockchain idea and applying it to other concepts also has a long history. In 2005, Nick Szabo came out with the concept of "secure property titles with owner authority", a document describing how "new advances in replicated database technology" will allow for a blockchain-based system for storing a registry of who owns what land, creating an elaborate framework including concepts such as homesteading, adverse possession and Georgian land tax. However, there was unfortunately no effective replicated database system available at the time, and so the protocol was never implemented in practice. After 2009, however, once Bitcoin's decentralized consensus was developed a number of alternative applications rapidly began to emerge:

● Namecoin - created in 2010, Namecoin is best described as a decentralized name registration database. In decentralized protocols like Tor, Bitcoin and BitMessage, there needs to be some way of identifying accounts so that other people can interact with them, but in all existing solutions the only kind of identifier available is a pseudorandom hash like 1LW79wp5ZBqaHW1jL5TCiBCrhQYtHagUWy. Ideally, one would like to be able to have an account with a name like "george". However, the problem is that if one person can create an account named "george" then someone else can use the same process to register "george" for themselves as well and impersonate them. The only solution is a first-to-file paradigm, where the first registrant succeeds and the second fails - a problem perfectly suited for the Bitcoin consensus protocol. Namecoin is the oldest, and most successful, implementation of a name registration system using such an idea.

● Colored coins - the purpose of colored coins is to serve as a protocol to allow people to create their own digital currencies - or, in the important trivial case of a currency with one unit, digital tokens, on the Bitcoin blockchain. In the colored coins protocol, one "issues" a new currency by publicly assigning a color to a specific Bitcoin UTXO, and the protocol recursively defines the color of other UTXO to be the same as the color of the inputs that the transaction creating them spent (some special rules apply in the case of mixed-color inputs). This allows users to maintain wallets containing only UTXO of a specific color and send them around much like regular bitcoins, backtracking through the blockchain to determine the color of any UTXO that they receive.

● Metacoins - the idea behind a metacoin is to have a protocol that lives on top of Bitcoin, using Bitcoin transactions to store metacoin transactions but having a different state transition function, APPLY'. Because the metacoin protocol cannot prevent invalid metacoin transactions from appearing in the Bitcoin blockchain, a rule is added that if APPLY'(S,TX) returns an error, the protocol defaults to APPLY'(S,TX) = S. This provides an easy mechanism for creating an arbitrary cryptocurrency protocol, potentially with advanced features that cannot be implemented inside of Bitcoin itself, but with a very low development cost since the complexities of mining and networking are already handled by the Bitcoin protocol.

Thus, in general, there are two approaches toward building a consensus protocol: building an independent network, and building a protocol on top of Bitcoin. The former approach, while reasonably successful in the case of applications like Namecoin, is difficult to implement; each individual implementation needs to bootstrap an independent blockchain, as well as building and testing all of the necessary state transition and networking code. Additionally, we predict that the set of applications for decentralized consensus technology will follow a power law distribution where the vast majority of applications would be too small to warrant their own blockchain, and we note that there exist large classes of decentralized applications, particularly decentralized autonomous organizations, that need to interact with each other.

The Bitcoin-based approach, on the other hand, has the flaw that it does not inherit the simplified payment verification features of Bitcoin. SPV works for Bitcoin because it can use blockchain depth as a proxy for validity; at some point, once the ancestors of a transaction go far enough back, it is safe to say that they were legitimately part of the state. Blockchain-based meta-protocols, on the other hand, cannot force the blockchain not to include transactions that are not valid within the context of their own protocols. Hence, a fully secure SPV meta-protocol implementation would need to backward scan all the way to the beginning of the Bitcoin blockchain to determine whether or not certain transactions are valid. Currently, all "light" implementations of Bitcoin-based meta-protocols rely on a trusted server to provide the data, arguably a highly suboptimal result especially when one of the primary purposes of a cryptocurrency is to eliminate the need for trust.

Nick Szabo is a computer scientist, legal scholar, and cryptographer known for his research in digital contracts and digital currency.

N. Szabo, Secure Property Titles with Owner Authority, 1998.

Namecoin is a key/value pair registration and transfer system based on the Bitcoin technology. Similarly, the Ethereum Name Service is a distributed, open, and extensible naming system based on the Ethereum blockchain that was started in 2016.

Tor is free, open-source software enabling anonymous communication by directing traffic through a worldwide, volunteer network.

Bitmessage is a decentralized, encrypted, peer-to-peer, trustless communications protocol released in November 2012.

In a first-to-file system, the right to the grant of a patent lies with the first person to file a patent application, regardless of the invention date.

The term "Colored Coins" loosely describes a class of methods for representing and managing real world assets on a blockchain.

In 2013, Buterin briefly worked with eToro CEO Yoni Assia on the Colored Coins project.

The Ethereum ERC20 Token Standard (proposed by Fabian Vogelsteller in 2015) allows for fungible tokens and is a similar concept to Colored Coins.

A metacoin protocol allows for advanced transactions (custom currencies, decentralized exchanges, derivatives etc) that are implemented on top of another blockchain. In this sense, colored coins are an example of a metacoin implementation.

Metacoins require a full client and cannot be supported by a Bitcoin light client. This was one of the reasons Vitalik decided to create Ethereum rather than build on the Bitcoin network.

1.6 Scripting

Even without any extensions, the Bitcoin protocol actually does facilitate a weak version of a concept of "smart contracts". UTXO in Bitcoin can be owned not just by a public key, but also by a more complicated script expressed in a simple stack-based programming language. In this paradigm, a transaction spending that UTXO must provide data that satisfies the script. Indeed, even the basic public key ownership mechanism is implemented via a script: the script takes an elliptic curve signature as input, verifies it against the transaction and the address that owns the UTXO, and returns 1 if the verification is successful and 0 otherwise. Other, more complicated, scripts exist for various additional use cases. For example, one can construct a script that requires signatures from two out of a given three private keys to validate ("multisig"), a setup useful for corporate accounts, secure savings accounts and some merchant escrow situations. Scripts can also be used to pay bounties for solutions to computational problems, and one can even construct a script that says something like "this Bitcoin UTXO is yours if you can provide an SPV proof that you sent a Dogecoin transaction of this denomination to me", essentially allowing decentralized cross-cryptocurrency exchange.

However, the scripting language as implemented in Bitcoin has several important limitations:

● Lack of Turing-completeness - that is to say, while there is a large subset of computation that the Bitcoin scripting language supports, it does not nearly support everything. The main category that is missing is loops. This is done to avoid infinite loops during transaction verification; theoretically it is a surmountable obstacle for script programmers, since any loop can be simulated by simply repeating the underlying code many times with an if statement, but it does lead to scripts that are very space-inefficient. For example, implementing an alternative elliptic curve signature algorithm would likely require 256 repeated multiplication rounds all individually included in the code.

● Value-blindness - there is no way for a UTXO script to provide fine-grained control over the amount that can be withdrawn. For example, one powerful use case of an oracle contract would be a hedging contract, where A and B put in $1000 worth of BTC and after 30 days the script sends $1000 worth of BTC to A and the rest to B. This would require an oracle to determine the value of 1 BTC in USD, but even then it is a massive improvement in terms of trust and infrastructure requirement over the fully centralized solutions that are available now. However, because UTXO are all-or-nothing, the only way to achieve this is through the very inefficient hack of having many UTXO of varying denominations (eg. one UTXO of 2k for every k up to 30) and having the oracle pick which UTXO to send to A and which to B.

● Blockchain-blindness - UTXO are blind to blockchain data such as the nonce and previous hash. This severely limits applications in gambling, and several other categories, by depriving the scripting language of a potentially valuable source of randomness.

Thus, we see three approaches to building advanced applications on top of cryptocurrency: building a new blockchain, using scripting on top of Bitcoin, and building a meta-protocol on top of Bitcoin. Building a new blockchain allows for unlimited freedom in building a feature set, but at the cost of development time and bootstrapping effort. Using scripting is easy to implement and standardize, but is very limited in its capabilities, and meta-protocols, while easy, suffer from faults in scalability. With Ethereum, we intend to build a generalized framework that can provide the advantages of all three paradigms at the same time.

A smart contract is a program that runs on a blockchain with the objectives of reduction in trusted intermediators, arbitrations, enforcement costs and fraud losses.

Many ideas underlying Bitcoin contracts were first described by Nick Szabo in Formalizing and Securing Relationships on Public Networks.

The Elliptic Curve Digital Signature Algorithm (ECDSA) offers a variant of the Digital Signature Algorithm (DSA) which uses elliptic curve cryptography.

Multisig is a digital signature scheme which allows a group of users to sign a single document.

Decentralized exchanges (DEX) are a type of cryptocurrency exchange which allows for direct peer-to-peer cryptocurrency transactions without the need for an intermediary.

A programming language that is Turing complete is theoretically capable of expressing all tasks accomplishable by computers

A bitcoin wallet balance is the sum of the UTXOs controlled by the wallet's private keys. It doesn't have a defined account balance.

UTXO code is deliberately limited. Coins can't tell what they're being divided into - this creates value-blindness in the case of an oracle contract.

Ethereum solves value and blockchain blindness through the use of accounts with balance and nonce fields.

2. Ethereum

The intent of Ethereum is to merge together and improve upon the concepts of scripting, altcoins and on-chain meta-protocols, and allow developers to create arbitrary consensus-based applications that have the scalability, standardization, feature-completeness, ease of development and interoperability offered by these different paradigms all at the same time. Ethereum does this by building what is essentially the ultimate abstract foundational layer: a blockchain with a built-in Turing-complete programming language, allowing anyone to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats and state transition functions. A bare-bones version of Namecoin can be written in two lines of code, and other protocols like currencies and reputation systems can be built in under twenty. Smart contracts, cryptographic "boxes" that contain value and only unlock it if certain conditions are met, can also be built on top of our platform, with vastly more power than that offered by Bitcoin scripting because of the added powers of Turing-completeness, value-awareness, blockchain-awareness and state.

2.1 Ethereum Accounts

In Ethereum, the state is made up of objects called "accounts", with each account having a 20-byte address and state transitions being direct transfers of value and information between accounts. An Ethereum account contains four fields:

● The nonce, a counter used to make sure each transaction can only be processed once

● The account's current ether balance

● The account's contract code, if present

● The account's storage (empty by default)

"Ether" is the main internal crypto-fuel of Ethereum, and is used to pay transaction fees. In general, there are two types of accounts: externally owned accounts, controlled by private keys, and contract accounts, controlled by their contract code. An externally owned account has no code, and one can send messages from an externally owned account by creating and signing a transaction; in a contract account, every time the contract account receives a message its code activates, allowing it to read and write to internal storage and send other messages or create contracts in turn.

An Ethereum account is an entity with an ether (ETH) balance that can send transactions on Ethereum. Accounts can be user-controlled via private key (Externally-owned) or deployed as smart contracts (Contract account).

An Externally-owned account costs nothing to create, can initiate transactions and transactions can only be ETH/token transfers.

A Contract account costs ETH to create because you're using network storage, can only send transactions in response to receiving a transaction and transactions from an external account can trigger code.

2.2 Messages and Transactions

"Messages" in Ethereum are somewhat similar to “transactions” in Bitcoin, but with three important differences. First, an Ethereum message can be created either by an external entity or a contract, whereas a Bitcoin transaction can only be created externally. Second, there is an explicit option for Ethereum messages to contain data. Finally, the recipient of an Ethereum message, if it is a contract account, has the option to return a response; this means that Ethereum messages also encompass the concept of functions.

The term "transaction" is used in Ethereum to refer to the signed data package that stores a message to be sent from an externally owned account. Transactions contain the recipient of the message, a signature identifying the sender, the amount of ether and the data to send, as well as two values called STARTGAS and GASPRICE. In order to prevent exponential blowup and infinite loops in code, each transaction is required to set a limit to how many computational steps of code execution it can spawn, including both the initial message and any additional messages that get spawned during execution. STARTGAS is this limit, and GASPRICE is the fee to pay to the miner per computational step. If transaction execution "runs out of gas", all state changes revert - except for the payment of the fees, and if transaction execution halts with some gas remaining then the remaining portion of the fees is refunded to the sender. There is also a separate transaction type, and corresponding message type, for creating a contract; the address of a contract is calculated based on the hash of the account nonce and transaction data.

An important consequence of the message mechanism is the "first class citizen" property of Ethereum - the idea that contracts have equivalent powers to external accounts, including the ability to send message and create other contracts. This allows contracts to simultaneously serve many different roles: for example, one might have a member of a decentralized organization (a contract) be an escrow account (another contract) between an paranoid individual employing custom quantum-proof Lamport signatures (a third contract) and a co-signing entity which itself uses an account with five keys for security (a fourth contract). The strength of the Ethereum platform is that the decentralized organization and the escrow contract do not need to care about what kind of account each party to the contract is.

Transactions are cryptographically signed instructions from accounts. An account will initiate a transaction to update the state of the Ethereum network.

Any node can broadcast a request for a transaction to be executed on the Ethereum Virtual Machine (EVM). After this happens, a miner will execute the transaction and propagate the resulting state change to the rest of the network.

At any given block in the chain, Ethereum has one and only one 'canonical' state, and the EVM is what defines the rules for computing a new valid state from block to block.

Ethereum is moving to a consensus mechanism called proof-of-stake (PoS) from proof-of-work (PoW) in 2022.

Gas refers to the unit that measures the amount of computational effort required to execute specific operations on the Ethereum network. Gas fees are paid in Ethereum's native currency, ether (ETH).

There are 2 main transaction types: Regular transactions from one wallet to another and contract deployment transactions without a 'to' address, where the data field is used for the contract code.

There are more transaction types, including legacy 'v' transactions and new Typed Transaction Envelope transactions defined by EIP-2718.

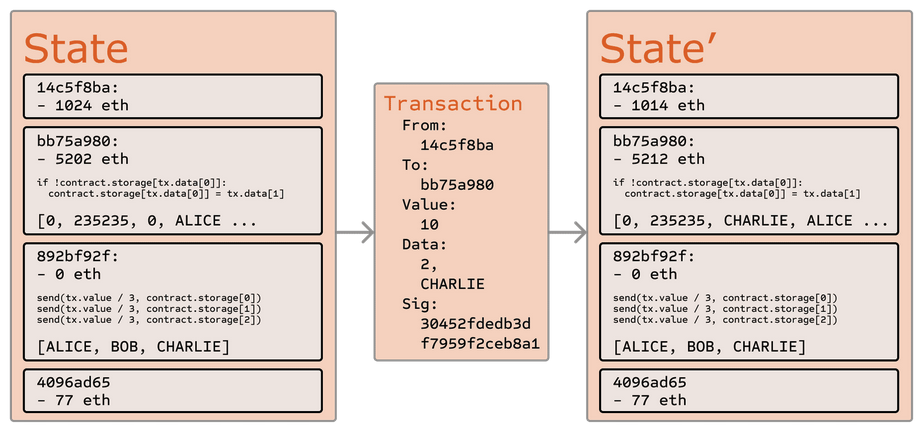

2.3 Ethereum State Transition Function

The Ethereum state transition function, APPLY(S,TX) -> S' can be defined as follows:

1. Check if the transaction is well-formed (ie. has the right number of values), the signature is valid, and the nonce matches the nonce in the sender's account. If not, return an error.

2. Calculate the transaction fee as STARTGAS * GASPRICE, and determine the sending address from the signature. Subtract the fee from the sender's account balance and increment the sender's nonce. If there is not enough balance to spend, return an error.

3. Initialize GAS = STARTGAS, and take off a certain quantity of gas per byte to pay for the bytes in the transaction.

4. Transfer the transaction value from the sender's account to the receiving account. If the receiving account does not yet exist, create it. If the receiving account is a contract, run the contract's code either to completion or until the execution runs out of gas.

5. If the value transfer failed because the sender did not have enough money, or the code execution ran out of gas, revert all state changes except the payment of the fees, and add the fees to the miner's account.

6. Otherwise, refund the fees for all remaining gas to the sender, and send the fees paid for gas consumed to the miner.

For example, suppose that the contract's code is:

if !contract.storage[msg.data[0]]:

contract.storage[msg.data[0]] = msg.data[1]

Note that in reality the contract code is written in the low-level EVM code; this example is written in Serpent, our high-level language, for clarity, and can be compiled down to EVM code. Suppose that the contract's storage starts off empty, and a transaction is sent with 10 ether value, 2000 gas, 0.001 ether gasprice, and two data fields: [ 2, 'CHARLIE' ][3]. The process for the state transition function in this case is as follows:

1. Check that the transaction is valid and well formed.

2. Check that the transaction sender has at least 2000 * 0.001 = 2 ether. If it is, then subtract 2 ether from the sender's account.

3. Initialize gas = 2000; assuming the transaction is 170 bytes long and the byte-fee is 5, subtract 850 so that there is 1150 gas left.

4. Subtract 10 more ether from the sender's account, and add it to the contract's account.

5. Run the code. In this case, this is simple: it checks if the contract's storage at index 2 is used, notices that it is not, and so it sets the storage at index 2 to the value CHARLIE. Suppose this takes 187 gas, so the remaining amount of gas is 1150 - 187 = 963

6. Add 963 * 0.001 = 0.963 ether back to the sender's account, and return the resulting state.

If there was no contract at the receiving end of the transaction, then the total transaction fee would simply be equal to the provided GASPRICE multiplied by the length of the transaction in bytes, and the data sent alongside the transaction would be irrelevant. Additionally, note that contract-initiated messages can assign a gas limit to the computation that they spawn, and if the sub-computation runs out of gas it gets reverted only to the point of the message call. Hence, just like transactions, contracts can secure their limited computational resources by setting strict limits on the sub-computations that they spawn.

The EVM behaves as a mathematical function would: Given an input, it produces a deterministic output. This is referred to as a state transition function.

The state is an enormous data structure called a modified Merkle Patricia Trie, which keeps all accounts linked by hashes and reducible to a single root hash stored on the blockchain.

Serpent is a deprecated assembly language that compiles to EVM code. Not recommended.

Solidity is recommeded as a high-level language for implementing smart contracts with Javascript/C++ style.

Vyper is the 2nd most popular language with a Pythonic style, although not as complete as Solidity.

Lisp Like Language (LLL) is good for close-to-the-metal optimizations

There are additional languages like Yul, Yul+, and Fe also.

Gas limit refers to the maximum amount of gas you are willing to consume on a transaction. More complicated transactions involving smart contracts require more computational work, so they require a higher gas limit than a simple payment. Although a transaction includes a limit, any gas not used in a transaction is returned to the user.

2.4 Code Execution

The code in Ethereum contracts is written in a low-level, stack-based bytecode language, referred to as "Ethereum virtual machine code" or "EVM code". The code consists of a series of bytes, where each byte represents an operation. In general, code execution is an infinite loop that consists of repeatedly carrying out the operation at the current program counter (which begins at zero) and then incrementing the program counter by one, until the end of the code is reached or an error or STOP or RETURN instruction is detected. The operations have access to three types of space in which to store data:

● The stack, a last-in-first-out container to which 32-byte values can be pushed and popped

● Memory, an infinitely expandable byte array

● The contract's long-term storage, a key/value store where keys and values are both 32 bytes. Unlike stack and memory, which reset after computation ends, storage persists for the long term.

The code can also access the value, sender and data of the incoming message, as well as block header data, and the code can also return a byte array of data as an output.

The formal execution model of EVM code is surprisingly simple. While the Ethereum virtual machine is running, its full computational state can be defined by the tuple (block_state, transaction, message, code, memory, stack, pc, gas), where block_state is the global state containing all accounts and includes balances and storage. Every round of execution, the current instruction is found by taking the pc-th byte of code, and each instruction has its own definition in terms of how it affects the tuple. For example, ADD pops two items off the stack and pushes their sum, reduces gas by 1 and increments pc by 1, and SSTORE pushes the top two items off the stack and inserts the second item into the contract's storage at the index specified by the first item, as well as reducing gas by up to 200 and incrementing pc by 1. Although there are many ways to optimize Ethereum via just-in-time compilation, a basic implementation of Ethereum can be done in a few hundred lines of code.

The EVM executes as a stack machine with a depth of 1024 items. Each item is a 256-bit word, which was chosen for the ease of use with 256-bit cryptography

Compiled smart contract bytecode executes as a number of EVM opcodes, which perform standard stack operations like XOR, AND, ADD, SUB, etc. The EVM also implements a number of blockchain-specific stack operations, such as ADDRESS, BALANCE, BLOCKHASH, etc. A list is available in the go-ethereum source code.

During execution, the EVM maintains a transient memory which does not persist between transactions. Contracts, however, do contain a Merkle Patricia storage trie associated with the account in question and part of the global state.

All EVM implementations must adhere to the specification described in the Ethereum Yellowpaper.

2.5 Blockchain and Mining

The Ethereum blockchain is in many ways similar to the Bitcoin blockchain, although it does have some differences. The main difference between Ethereum and Bitcoin with regard to the blockchain architecture is that, unlike Bitcoin, Ethereum blocks contain a copy of both the transaction list and the most recent state. Aside from that, two other values, the block number and the difficulty, are also stored in the block. The block validation algorithm in Ethereum is as follows:

1. Check if the previous block referenced exists and is valid.

2. Check that the timestamp of the block is greater than that of the referenced previous block and less than 15 minutes into the future

3. Check that the block number, difficulty, transaction root, uncle root and gas limit (various low-level Ethereum-specific concepts) are valid.

4. Check that the proof of work on the block is valid.

5. Let S[0] be the STATE_ROOT of the previous block.

6. Let TX be the block's transaction list, with n transactions. For all in in 0...n-1, setS[i+1] =

APPLY(S[i],TX[i]). If any applications returns an error, or if the total gas consumed in the block up

until this point exceeds the GASLIMIT, return an error.

7. Let S_FINAL be S[n], but adding the block reward paid to the miner.

8. Check if S_FINAL is the same as the STATE_ROOT. If it is, the block is valid; otherwise, it is not valid.

The approach may seem highly inefficient at first glance, because it needs to store the entire state with each block, but in reality efficiency should be comparable to that of Bitcoin. The reason is that the state is stored in the tree structure, and after every block only a small part of the tree needs to be changed. Thus, in general, between two adjacent blocks the vast majority of the tree should be the same, and therefore the data can be stored once and referenced twice using pointers (ie. hashes of subtrees). A special kind of tree known as a "Patricia tree" is used to accomplish this, including a modification to the Merkle tree concept that allows for nodes to be inserted and deleted, and not just changed, efficiently. Additionally, because all of the state information is part of the last block, there is no need to store the entire blockchain history - a strategy which, if it could be applied to Bitcoin, can be calculated to provide 5-20x savings in space.

Blocks are batches of transactions with a hash of the previous block in the chain. This links blocks together (in a chain) because hashes are cryptographically derived from the block data.

What's in an Ethereum block?

1. timestamp

2. blockNumber

3. baseFeePerGas

4. difficulty

5. mixHash

6. parentHash

7. transactions

8. stateRoot

9. nonce

The proof-of-work protocol, Ethash, requires miners to go through a race of trial and error to find the nonce for a block. Only blocks with a valid nonce can be added to the chain.

When racing to mine a block, a miner will repeatedly put a dataset, that you can only get from downloading and running the full chain (as a miner does), through a mathematical function. The dataset gets used to generate a mixHash below a target nonce, as dictated by the block difficulty.

The difficulty determines the target for the hash. The lower the target, the smaller the set of valid hashes. Once generated, this is incredibly easy for other miners and clients to verify.

The objective of proof-of-work is to extend the chain. The longest chain is most believable as the valid one because it's had the most computational work done. To consistently create malicious yet valid blocks, you'd need over 51% of the network mining power.

A major criticism of proof-of-work is the amount of energy output required to keep the network safe.

Ethereum is moving to a consensus mechanism called proof-of-stake from proof-of-work in 2022. At a high level, proof-of-stake has the same end goal as proof-of-work: to help the decentralized network reach consensus securely.

3. Applications

In general, there are three types of applications on top of Ethereum. The first category is financial applications, providing users with more powerful ways of managing and entering into contracts using their money. This includes sub-currencies, financial derivatives, hedging contracts, savings wallets, wills, and ultimately even some classes of full-scale employment contracts. The second category is semi-financial applications, where money is involved but there is also a heavy non-monetary side to what is being done; a perfect example is self-enforcing bounties for solutions to computational problems. Finally, there are applications such as online voting and decentralized governance that are not financial at all.

3.1 Token Systems

On-blockchain token systems have many applications ranging from sub-currencies representing assets such as USD or gold to company stocks, individual tokens representing smart property, secure unforgeable coupons, and even token systems with no ties to conventional value at all, used as point systems for incentivization. Token systems are surprisingly easy to implement in Ethereum. The key point to understand is that all a currency, or token systen, fundamentally is is a database with one operation: subtract X units from A and give X units to B, with the proviso that (i) X had at least X units before the transaction and (2) the transaction is approved by A. All that it takes to implement a token system is to implement this logic into a contract.

The basic code for implementing a token system in Serpent looks as follows:

from = msg.sender

to = msg.data[0]

value = msg.data[1]

if contract.storage[from] >= value:

contract.storage[from] = contract.storage[from] value

contract.storage[to] = contract.storage[to] + value

This is essentially a literal implementation of the "banking system" state transition function described further above in this document. A few extra lines of code need to be added to provide for the initial step of distributing the currency units in the first place and a few other edge cases, and ideally a function would be added to let other contracts query for the balance of an address. But that's all there is to it. Theoretically, Ethereum-based token systems acting as sub-currencies can potentially include another important feature that on-chain Bitcoin-based meta-currencies lack: the ability to pay transaction fees directly in that currency. The way this would be implemented is that the contract would maintain an ether balance with which it would refund ether used to pay fees to the sender, and it would refill this balance by collecting the internal currency units that it takes in fees and reselling them in a constant running auction. Users would thus need to "activate" their accounts with ether, but once the ether is there it would be reusable because the contract would refund it each time.

There are thousands of Ethereum tokens standardised by the ERC-20 fungible token standard, where by fungibility is the property of a good or a commodity whose individual units are essentially interchangeable

Additionally there are other ERC token standards for non-fungible tokens (NFT's).

3.2 Financial derivatives and Stable-Value Currencies

Financial derivatives are the most common application of a "smart contract", and one of the simplest to implement in code. The main challenge in implementing financial contracts is that the majority of them require reference to an external price ticker; for example, a very desirable application is a smart contract that hedges against the volatility of ether (or another cryptocurrency) with respect to the US dollar, but doing this requires the contract to know what the value of ETH/USD is. The simplest way to do this is through a "data feed" contract maintained by a specific party (eg. NASDAQ) designed so that that party has the ability to update the contract as needed, and providing an interface that allows other contracts to send a message to that contract and get back a response that provides the price.

Given that critical ingredient, the hedging contract would look as follows:

1. Wait for party A to input 1000 ether.

2. Wait for party B to input 1000 ether.

3. Record the USD value of 1000 ether, calculated by querying the data feed contract, in storage, say this is $x.

4. After 30 days, allow A or B to "ping" the contract in order to send $x worth of ether (calculated by querying the data feed contract again to get the new price) to A and the rest to B.

Such a contract would have significant potential in crypto-commerce. One of the main problems cited about cryptocurrency is the fact that it's volatile; although many users and merchants may want the security and convenience of dealing with cryptographic assets, they many not wish to face that prospect of losing 23% of the value of their funds in a single day. Up until now, the most commonly proposed solution has been issuer-backed assets; the idea is that an issuer creates a sub-currency in which they have the right to issue and revoke units, and provide one unit of the currency to anyone who provides them (offline) with one unit of a specified underlying asset (eg. gold, USD). The issuer then promises to provide one unit of the underlying asset to anyone who sends back one unit of the crypto-asset. This mechanism allows any non-cryptographic asset to be "uplifted" into a cryptographic asset, provided that the issuer can be trusted.

In practice, however, issuers are not always trustworthy, and in some cases the banking infrastructure is too weak, or too hostile, for such services to exist. Financial derivatives provide an alternative. Here, instead of a single issuer providing the funds to back up an asset, a decentralized market of speculators, betting that the price of a cryptographic reference asset will go up, plays that role. Unlike issuers, speculators have no option to default on their side of the bargain because the hedging contract holds their funds in escrow. Note that this approach is not fully decentralized, because a trusted source is still needed to provide the price ticker, although arguably even still this is a massive improvement in terms of reducing infrastructure requirements (unlike being an issuer, issuing a price feed requires no licenses and can likely be categorized as free speech) and reducing the potential for fraud.

Decentralized Finance (DeFi) is a blockchain-based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments, and instead utilizes smart contracts on blockchains.

As of Nov 2021, approximately $106 billion USD was invested in DeFi according to defipulse.com, with a majority powered by Ethereum.

DAI is an example of an Ethereum based stable coin that is soft pegged to the US Dollar.

Chainlink is an example of a Ethereum based distributed oracle enabling the creation of hybrid smart contracts by connecting with the outside world.

Uniswap is an example of a decentralized finance protocol that is used to exchange cryptocurrencies.

3.3 Identity and Reputation Systems

The earliest alternative cryptocurrency of all, Namecoin, attempted to use a Bitcoin-like blockchain to provide a name registration system, where users can register their names in a public database alongside other data. The major cited use case is for a DNS system, mapping domain names like "bitcoin.org" (or, in Namecoin's case, "bitcoin.bit") to an IP address. Other use cases include email authentication and potentially more advanced reputation systems. Here is the basic contract to provide a Namecoin-like name registration system on Ethereum:

if !contract.storage[tx.data[0]]:

contract.storage[tx.data[0]] = tx.data[1]

The contract is very simple; all it is is a database inside the Ethereum network that can be added to, but not modified or removed from. Anyone can register a name with some value, and that registration then sticks forever. A more sophisticated name registration contract will also have a "function clause" allowing other contracts to query it, as well as a mechanism for the "owner" (ie. the first registerer) of a name to change the data or transfer ownership. One can even add reputation and web-of-trust functionality on top.

Ethereum Name Service (ENS) is a decentralized naming system allowing human-readable names like "bob.eth" to map to identifiers such as addresses, content hashes, and metadata.

EIP-4361 is an early proposal to standardize off-chain authentication for Ethereum accounts to establish sessions.

3.4 Decentralized File Storage

Over the past few years, there have emerged a number of popular online file storage startups, the most prominent being Dropbox, seeking to allow users to upload a backup of their hard drive and have the service store the backup and allow the user to access it in exchange for a monthly fee. However, at this point the file storage market is at times relatively inefficient; a cursory look at various existing solutions shows that, particularly at the "uncanny valley" 20-200 GB level at which neither free quotas nor enterprise-level discounts kick in, monthly prices for mainstream file storage costs are such that you are paying for more than the cost of the entire hard drive in a single month. Ethereum contracts can allow for the development of a decentralized file storage ecosystem, where individual users can earn small quantities of money by renting out their own hard drives and unused space can be used to further drive down the costs of file storage.

The key underpinning piece of such a device would be what we have termed the "decentralized Dropbox contract". This contract works as follows. First, one splits the desired data up into blocks, encrypting each block for privacy, and builds a Merkle tree out of it. One then makes a contract with the rule that, every N blocks, the contract would pick a random index in the Merkle tree (using the previous block hash, accessible from contract code, as a source of randomness), and give X ether to the first entity to supply a transaction with a simplified payment verification-like proof of ownership of the block at that particular index in the tree. When a user wants to re-download their file, they can use a micropayment channel protocol (eg. pay 1 szabo per 32 kilobytes) to recover the file; the most fee-efficient approach is for the payer not to publish the transaction until the end, instead replacing the transaction with a slightly more lucrative one with the same nonce after every 32 kilobytes.

An important feature of the protocol is that, although it may seem like one is trusting many random nodes not to decide to forget the file, one can reduce that risk down to near-zero by splitting the file into many pieces via secret sharing, and watching the contracts to see each piece is still in some node's possession. If a contract is still paying out money, that provides a cryptographic proof that someone out there is still storing the file.

Decentralized storage systems consist of a peer-to-peer network of user-operators who hold a portion of the overall data, creating a resilient file storage sharing system.

Ethereum itself can be used as a decentralized storage system, and it is when it comes to code storage in all the smart contracts. However, when it comes to large amounts of data, that isn't what Ethereum was designed for.

In most cases, instead of storing all data on-chain, the hash of where the data is located on a chain gets stored. This way, the entire chain doesn't need to scale to keep all of the data.

Filecoin (FIL) is a decentralized storage network based on the Interplanetary File Storage (IPFS) protocol.

Storj (STORJ) is an open-source platform that leverages the blockchain to provide end-to-end encrypted cloud storage services.

Swarm (BZZ) is a system of peer-to-peer networked nodes that create a decentralised storage and communication service. The system is economically self-sustaining due to a built-in incentive system enforced through smart contracts on the Ethereum blockchain.

3.5 Decentralized Autonomous Organizations

The general concept of a "decentralized organization" is that of a virtual entity that has a certain set of members or shareholders which, perhaps with a 67% majority, have the right to spend the entity's funds and modify its code. The members would collectively decide on how the organization should allocate its funds. Methods for allocating a DAO's funds could range from bounties, salaries to even more exotic mechanisms such as an internal currency to reward work. This essentially replicates the legal trappings of a traditional company or nonprofit but using only cryptographic blockchain technology for enforcement. So far much of the talk around DAOs has been around the "capitalist" model of a "decentralized autonomous corporation" (DAC) with dividend-receiving shareholders and tradable shares; an alternative, perhaps described as a "decentralized autonomous community", would have all members have an equal share in the decision making and require 67% of existing members to agree to add or remove a member. The requirement that one person can only have one membership would then need to be enforced collectively by the group.

A general outline for how to code a DO is as follows. The simplest design is simply a piece of self-modifying code that changes if two thirds of members agree on a change. Although code is theoretically immutable, one can easily get around this and have de-facto mutability by having chunks of the code in separate contracts, and having the address of which contracts to call stored in the modifiable storage. In a simple implementation of such a DAO contract, there would be three transaction types, distinguished by the data provided in the transaction:

● [0,i,K,V] to register a proposal with index i to change the address at storage index K to value V

● [0,i] to register a vote in favor of proposal i

● [2,i] to finalize proposal i if enough votes have been made

The contract would then have clauses for each of these. It would maintain a record of all open storage changes, along with a list of who voted for them. It would also have a list of all members. When any storage change gets to two thirds of members voting for it, a finalizing transaction could execute the change. A more sophisticated skeleton would also have built-in voting ability for features like sending a transaction, adding members and removing members, and may even provide for Liquid Democracy-style vote delegation (ie. anyone can assign someone to vote for them, and assignment is transitive so if A assigns B and B assigns C then C determines A's vote). This design would allow the DO to grow organically as a decentralized community, allowing people to eventually delegate the task of filtering out who is a member to specialists, although unlike in the "current system" specialists can easily pop in and out of existence over time as individual community members change their alignments.

An alternative model is for a decentralized corporation, where any account can have zero or more shares, and two thirds of the shares are required to make a decision. A complete skeleton would involve asset management functionality, the ability to make an offer to buy or sell shares, and the ability to accept offers (preferably with an order-matching mechanism inside the contract). Delegation would also exist Liquid Democracy-style, generalizing the concept of a "board of directors".

In the future, more advanced mechanisms for organizational governance may be implemented; it is at this point that a decentralized organization (DO) can start to be described as a decentralized autonomous organization (DAO). The difference between a DO and a DAO is fuzzy, but the general dividing line is whether the governance is generally carried out via a political-like process or an “automatic” process; a good intuitive test is the “no common language” criterion: can the organization still function if no two members spoke the same language? Clearly, a simple traditional shareholder-style corporation would fail, whereas something like the Bitcoin protocol would be much more likely to succeed. Robin Hanson’s futarchy, a mechanism for organizational governance via prediction markets, is a good example of what truly “autonomous” governance might look like. Note that one should not necessarily assume that all DAOs are superior to all DOs; automation is simply a paradigm that is likely to have have very large benefits in certain particular places and may not be practical in others, and many semi-DAOs are also likely to exist.

A decentralized autonomous organization (DAO) is an organization represented by rules encoded as a computer program that is transparent, controlled by the organization members. A DAO's financial transaction record and program rules are maintained on a blockchain.

MakerDAO is a project on Ethereum and a DAO created in 2014. The project is managed by people around the world who hold its governance token, MKR. MKR holders are responsible for governing the Maker Protocol, which includes adjusting policy for the Dai stablecoin, choosing new collateral types, and improving governance itself.

The ENS DAO is a DAO, created in 2021, that governs the ENS protocol, a decentralized naming system. The project is managed by people around the world who hold its governance token, ENS.

Once a contract is in the blockchain, it is final and cannot be changed. Certain parameters, of course, can be changed if they are allowed to change via the original code. One method of updating contracts is to use a versioning system. For example, you could have an entryway contract that just forwards all calls to the most recent version of the contract, as defined by an updatable address parameter.

Futarchy is a form of government proposed by economist Robin Hanson, in which elected officials define measures of national wellbeing, and prediction markets are used to determine which policies will have the most positive effect.

3.6 Further Applications

1. Savings wallets. Suppose that Alice wants to keep her funds safe, but is worried that she will lose or someone will hack her private key. She puts ether into a contract with Bob, a bank, as follows:

● Alice alone can withdraw a maximum of 1% of the funds per day.

● Bob alone can withdraw a maximum of 1% of the funds per day, but Alice has the ability to make a transaction with her key shutting off this ability.

● Alice and Bob together can withdraw anything.

Normally, 1% per day is enough for Alice, and if Alice wants to withdraw more she can contact Bob for help. If Alice's key gets hacked, she runs to Bob to move the funds to a new contract. If she loses her key, Bob will get the funds out eventually. If Bob turns out to be malicious, then she can turn off his ability to withdraw.

2. Crop insurance. One can easily make a financial derivatives contract but using a data feed of the weather instead of any price index. If a farmer in Iowa purchases a derivative that pays out inversely based on the precipitation in Iowa, then if there is a drought, the farmer will automatically receive money and if there is enough rain the farmer will be happy because their crops would do well.

3. A decentralized data feed. For financial contracts for difference, it may actually be possible to decentralize the data feed via a protocol called "SchellingCoin". SchellingCoin basically works as follows: N parties all put into the system the value of a given datum (eg. the ETH/USD price), the values are sorted, and everyone between the 25th and 75th percentile gets one token as a reward. Everyone has the incentive to provide the answer that everyone else will provide, and the only value that a large number of players can realistically agree on is the obvious default: the truth. This creates a decentralized protocol that can theoretically provide any number of values, including the ETH/USD price, the temperature in Berlin or even the result of a particular hard computation.

4. Smart multi-signature escrow. Bitcoin allows multisignature transaction contracts where, for example, three out of a given five keys can spend the funds. Ethereum allows for more granularity; for example, four out of five can spend everything, three out of five can spend up to 10% per day, and two out of five can spend up to 0.5% per day. Additionally, Ethereum multisig is asynchronous - two parties can register their signatures on the blockchain at different times and the last signature will automatically send the transaction.

5. Cloud computing. The EVM technology can also be used to create a verifiable computing environment, allowing users to ask others to carry out computations and then optionally ask for proofs that computations at certain randomly selected checkpoints were done correctly. This allows for the creation of a cloud computing market where any user can participate with their desktop, laptop or specialized server, and spot-checking together with security deposits can be used to ensure that the system is trustworthy (ie. nodes cannot profitably cheat). Although such a system may not be suitable for all tasks; tasks that require a high level of inter-process communication, for example, cannot easily be done on a large cloud of nodes. Other tasks, however, are much easier to parallelize; projects like SETI@home, folding@home and genetic algorithms can easily be implemented on top of such a platform.

6. Peer-to-peer gambling. Any number of peer-to-peer gambling protocols, such as Frank Stajano and Richard Clayton's Cyberdice, can be implemented on the Ethereum blockchain. The simplest gambling protocol is actually simply a contract for difference on the next block hash, and more advanced protocols can be built up from there, creating gambling services with near-zero fees that have no ability to cheat.

7. Prediction markets. Provided an oracle or SchellingCoin, prediction markets are also easy to implement, and prediction markets together with SchellingCoin may prove to be the first mainstream application of futarchy as a governance protocol for decentralized organizations.

8. On-chain decentralized marketplaces, using the identity and reputation system as a base.

Applications that run with a blockchain backend are called distributed apps (dapps).

Today there are many dapps around finance, collectibles, gaming, prediction markets, exchanges, marketplaces, etc.

Some dapp lists (current as of Nov 2021) are:

ethereum.org dapps

stateofthedapps.com dapps

dappradar.com dapps

In game theory, a focal point (or Schelling point) is a solution that people tend to choose by default in the absence of communication.

A SchellingCoin allows for a minimal-trust universal data feed.

Cyberdice is a peer-to-peer gambling in the presence of cheaters paper by Frank Stajano and Richard Clayton.

4. Miscellanea And Concerns

4.1 Modified GHOST Implementation

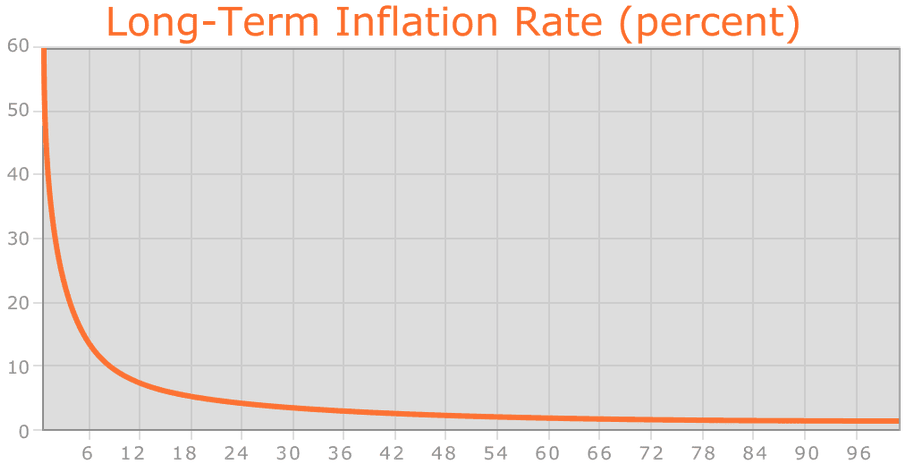

The "Greedy Heaviest Observed Subtree" (GHOST) protocol is an innovation first introduced by Yonatan Sompolinsky and Aviv Zohar in December 2013. The motivation behind GHOST is that blockchains with fast confirmation times currently suffer from reduced security due to a high stale rate - because blocks take a certain time to propagate through the network, if miner A mines a block and then miner B happens to mine another block before miner A's block propagates to B, miner B's block will end up wasted and will not contribute to network security. Furthermore, there is a centralization issue: if miner A is a mining pool with 30% hashpower and B has 10% hashpower, A will have a risk of producing a stale block 70% of the time (since the other 30% of the time A produced the last block and so will get mining data immediately) whereas B will have a risk of producing a stale block 90% of the time. Thus, if the block interval is short enough for the stale rate to be high, A will be substantially more efficient simply by virtue of its size. With these two effects combined, blockchains which produce blocks quickly are very likely to lead to one mining pool having a large enough percentage of the network hashpower to have de facto control over the mining process.